Empower Your Funds With a Federal Cooperative Credit Union

With a focus on offering competitive rate of interest rates, customized solution, and a varied variety of monetary items, federal credit report unions have emerged as a practical choice to standard business financial institutions. By diving right into the world of government credit report unions, individuals can unlock a host of benefits that may just reinvent the method they handle their funds.

Advantages of Joining a Federal Cooperative Credit Union

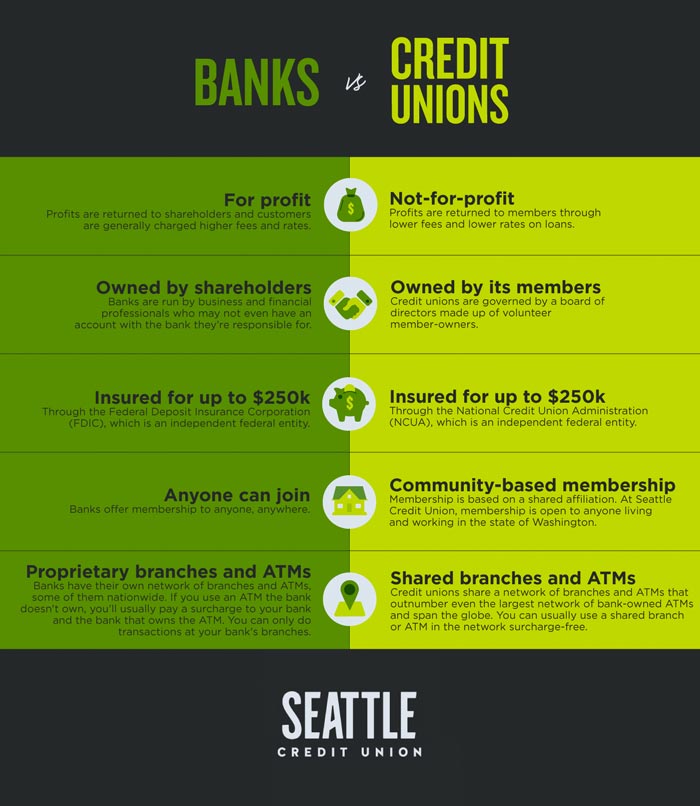

Signing up with a federal cooperative credit union presents numerous advantages for people seeking financial security and personalized financial services. One of the main advantages is the member-focused approach that government cooperative credit union supply. Unlike standard financial institutions, federal cooperative credit union are not-for-profit companies owned and operated by their participants. This structure permits them to prioritize the economic wellness of their members above all else. Therefore, federal lending institution frequently provide reduced rates of interest on car loans, higher rate of interest on cost savings accounts, and less charges compared to industrial banks.

In addition, federal cooperative credit union are understood for their remarkable consumer solution. Participants can expect a much more customized experience, with staff participants that are committed to aiding them accomplish their monetary goals. Whether it's requesting a lending, establishing a savings plan, or merely seeking financial suggestions, government cooperative credit union are dedicated to offering the assistance and support that their participants need - Cheyenne Federal Credit Union. In general, joining a federal lending institution can lead to a more financially safe and secure future and a much more positive financial experience.

How to Sign Up With a Federal Lending Institution

To end up being a participant of a Federal Cooperative credit union, people have to fulfill specific eligibility requirements developed by the establishment. These criteria typically consist of elements such as place, work standing, membership in specific organizations, or coming from a particular neighborhood. Federal Cooperative credit union are known for their comprehensive subscription plans, typically permitting individuals from a variety of histories to sign up with.

The primary step in signing up with a Federal Debt Union is to figure out if you satisfy the qualification needs set forth by the establishment. This info can typically be located on the credit rating union's website or by contacting their subscription department directly. When eligibility is verified, individuals can continue with the subscription application procedure, which may entail completing an application and giving proof of qualification.

After submitting the essential documentation, the cooperative credit union will certainly examine the application and notify the person of their membership standing. Upon approval, new participants can begin taking pleasure in the solutions and benefits supplied by the Federal Lending Institution. Signing Up With a Federal Credit rating Union can give people with accessibility to competitive financial items, personalized customer care, and a feeling of community involvement.

Managing Your Money Efficiently

Efficient management of personal funds is important for attaining lasting monetary stability and protection. Establishing monetary goals is another essential aspect of cash monitoring.

Regularly reviewing your monetary circumstance is crucial. Furthermore, remaining notified concerning monetary issues, such as passion prices, investment alternatives, and credit ratings, can assist you make educated decisions and grow your wide range over time. By managing your cash efficiently, you can work towards accomplishing your financial objectives and securing a stable future.

Financial Providers Offered by Federal Cooperative Credit Union

Federal lending institution offer a range of monetary solutions customized to fulfill the diverse needs of their members. These solutions typically include cost savings and checking accounts, car loans for numerous purposes such as auto fundings, home loans, personal lendings, and charge card - Credit Unions Cheyenne. Participants of federal lending institution can likewise gain from investment services, retired life planning, insurance policy items, and economic education resources

Among the essential advantages of making use of economic services supplied by federal lending institution is the individualized strategy to member demands. Unlike standard financial institutions, lending institution are member-owned, not-for-profit organizations that prioritize the monetary health of their members most of all else. This member-centric focus commonly equates into lower charges, competitive rate of interest, and a lot more versatile borrowing terms.

In addition, federal lending institution are known for their community-oriented philosophy, commonly providing assistance and sources to aid participants accomplish their financial objectives. By providing a thorough collection of monetary services, government cooperative credit union empower their participants to make audio financial choices and job towards a safe monetary future.

Maximizing Your Financial Savings With a Lending Institution

When looking for to enhance your financial savings strategy, checking out the potential benefits of straightening with a cooperative credit union can supply important possibilities for monetary growth and stability. Cooperative credit union, as member-owned financial cooperatives, focus on the health of their members, frequently supplying higher interest prices on interest-bearing accounts compared to typical banks. By making use of these competitive prices, you can maximize the growth of your savings over time.

Furthermore, lending institution typically have lower fees and account minimums, allowing you to keep more of your cost savings working for you. Some lending institution also use unique financial savings programs or accounts created to aid participants reach particular financial goals, such as conserving for a retired life, education, or home.

In addition, lending institution are understood for their tailored solution and commitment to economic education and learning. By building a partnership with your cooperative credit union, you can acquire pop over to these guys accessibility to experienced suggestions on saving strategies, investment choices, and more, empowering you to make informed choices that line up with your monetary goals. On the whole, optimizing your savings with a cooperative credit union can be a smart and efficient means to grow your riches while protecting your monetary future.

Conclusion

Finally, signing up with a government cooperative credit union can equip your financial resources by providing reduced my blog rate of interest rates on lendings, higher rate of interest prices on interest-bearing accounts, and individualized customer support. By benefiting from the financial solutions offered, managing your money efficiently, and optimizing your savings, you can construct wide range and safeguard your financial future. Think about signing up with a federal credit union to experience the benefits of a member-focused method to monetary health.

Whether it's applying for a lending, establishing up a cost savings plan, or just seeking financial guidance, government credit score unions are devoted to providing the assistance and guidance that their participants need (Cheyenne Credit Unions). Joining a Federal Credit report Union can provide individuals with access to affordable economic items, personalized customer service, and a feeling of neighborhood involvement

Federal content credit score unions provide an array of financial solutions tailored to fulfill the diverse requirements of their members. Participants of federal debt unions can also benefit from investment services, retirement preparation, insurance coverage products, and monetary education sources.

Comments on “Wyoming Federal Credit Union: Comprehensive Financial Services And Products”